Why is the UK venture capital scene changing so quickly? What does this mean for investors and startups?

We’re taking a close look at UK venture capital. We’ll explore investment strategies and new trends. Our goal is to give you a clear view of current ventures.

Recently, the UK’s venture capital sector has seen big changes. We’ll look at reports and data to find out why. This helps us see what the future may hold.

We’re exploring everything from new funding ways to growing sectors. Let’s discover the UK’s investment changes and the future of venture capital.

Current State of Venture Capital in the UK

The UK is a leading player in the global venture capital market. Recent data show trends, key sectors, and economic impacts on this scene. This gives us a clear picture of where venture capital stands today.

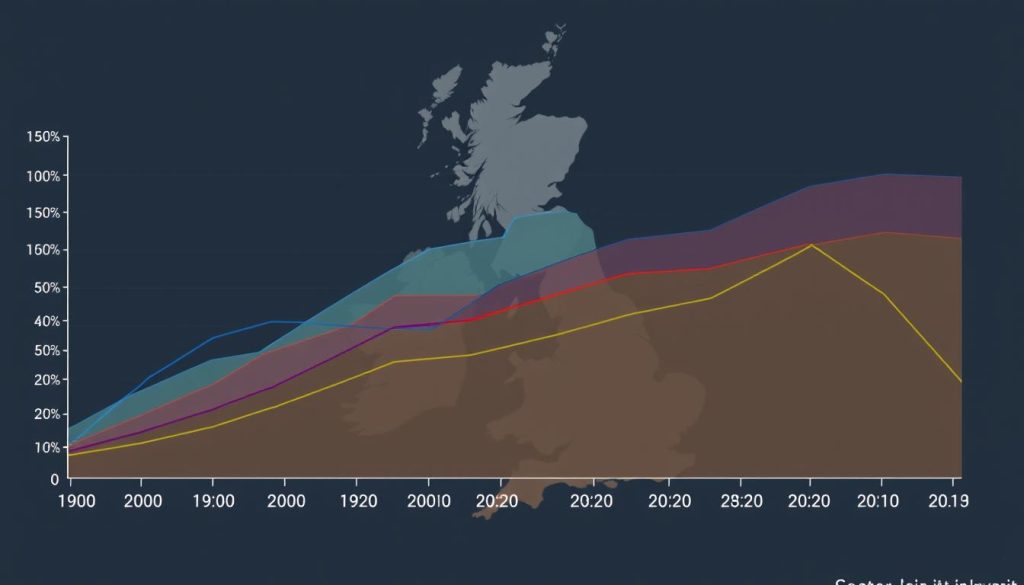

Investment Growth and Patterns

PitchBook data reveals a spike in venture capital activity in the UK. This has led to significant growth in investments. More deals are being made, and their value is rising. Startups using new technologies are getting much attention.

Key Sectors Attracting Investment

The British Venture Capital Association points out fintech, healthtech, and greentech as top investment areas. These sectors are innovating and receiving a lot of startup funding. Fintech is especially strong, changing how the financial sector works. Healthtech and greentech are also making big steps towards sustainability.

Economic and Political Influences

The venture capital scene has felt the impact of economic changes. Brexit and the global pandemic have been key factors. The Economist shows how these changes have made venture capital firms rethink their strategies. They’re adjusting to the new economic landscape.

Emerging Venture Capital Trends

The venture capital scene is changing, with several key trends appearing. Investors are now focusing more on how sustainable their investments are. They are using advanced technologies. They are also looking more at early-stage startups.

Sustainability and ESG Investment

ESG-focused funds are becoming more popular, showing that investors care about the environment, society, and good company management. Sifted.eu says investors now prefer companies that are serious about being sustainable. This interest is because sustainable companies often perform better financially.

Technological Innovations in Investment

Technology is changing how venture capital firms work. TechCrunch explains that AI helps them make decisions faster, from checking investments to managing them. Blockchain is also being used to make investments more transparent and secure.

Shift Toward Early-Stage Startups

There’s a growing interest in investing in startups early on, as the Venture Capital Journal points out. Investors see big chances in new companies and are ready to risk more for bigger gains. This approach is encouraging new ideas and helping young businesses when they need it most.

Impact of Brexit on Venture Capital

Brexit has clearly changed the Brexit investment climate in the UK. The country’s move from the EU meant venture capitalists had to adjust to new rules. This change affected how venture capital moved.

At first, the unknown details of the UK’s exit made investors careful. But now, with clearer rules, the post-Brexit venture capital scene is getting stable. The UK’s Department for International Trade has helped make this transition smoother.

After Brexit, the way we work with international partners has changed. Some are waiting to see what the UK’s new trade deals will be like. But others see this as a chance to benefit from the UK’s new rules.

Now, the UK is focusing on innovation and growth again. With help from the government and certain financial boosts, it aims to be a top place for post-Brexit venture capital. Despite the hurdles, there’s a positive view on the future of venture capital here.

Role of Government Policies in Shaping Venture Capital

Government actions deeply influence venture capital. They do this by offering tax breaks and supportive rules. This helps money flow to new and growing businesses. People who invest, start companies, or work in venture capital must grasp these rules.

Tax Incentives and Reliefs

The Enterprise Investment Scheme (EIS) is key for encouraging investment in new firms. The UK tax office runs it, providing startup tax benefits. It lets investors get tax relief when they put money into eligible businesses. This reduces the financial risk, drawing more investment into promising startups.

Other programs, like the Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts (VCTs), also offer tax perks. Together, they make a strong system. This ensures startups get the funds they need to be innovative and grow.

Regulatory Frameworks

The rules for venture capital investments also shape how money is put in. The UK works with groups like the UK Business Angels Association to make investing straightforward. They aim for clear rules and easy entry for investors.

These rules strive for a balance. They protect investors while keeping the investment environment flexible and appealing. The government updates these rules often. This keeps the UK a top place for venture capital money.

To succeed in venture capital, understanding these tax perks and rules is a must. With the right knowledge, investors can make smart choices. They can follow both their financial aims and the law.

Challenges Faced by Venture Capital Firms

The UK’s venture capital scene is changing fast. This brings many challenges for firms. Finding high-potential startups is hard due to market saturation.

Competition is fierce, with many firms chasing few opportunities. This pushes up startup values and makes investing tricky.

Balancing risk with reward is tough. The British Venture Capital Association survey says investment risks are a big concern. Early-stage ventures and emerging markets add to this challenge.

Firms must stand out by being innovative and focusing on niche markets. Offering unique services and knowing the industry well helps them compete. But, they must keep adapting to survive and succeed in the UK.

A clear strategy is essential to overcome these hurdles. This includes analysing the market, managing risks well, and being ready to change quickly. This is how venture capital firms can grow.

Global Influences on UK Venture Capital

The UK’s venture capital scene has grown thanks to global forces. International partnerships and cross-border investments are key. They help the market grow and become more diverse. This shows how crucial global VC collaborations are. And how important it is to have funding from abroad. These factors help increase the money available. They also help create a lively international venture scene.

International Partnerships

International partnerships are very important for the UK’s venture capital. The London Stock Exchange Group has shown many successful examples. These partnerships help British startups find new opportunities. They can reach more people and enter new markets. This makes global VC collaborations even more effective.

Cross-Border Investments

Cross-border investments have made the UK more important in the global venture scene. A report from CB Insights shows more investments are coming from abroad. These investments give startups the money they need. They also bring new ideas that can lead to innovation and growth. The increase in international investments shows the UK’s venture capital market is well-connected to the world.

Future of Venture Capital in Emerging Markets

The world of venture capital is about to change a lot, with a big focus on new market chances. Experts from the World Economic Forum believe that fast-growing markets will see a big increase in venture capital.

Several important reasons are driving the potential of these growing markets:

- Demographic Dividend: Places like India and Brazil have young people and cities growing quickly. This makes them great for new ideas and investments.

- Technological Adoption: As more people get access to mobiles and the internet, these markets are changing fast thanks to technology.

- Improving Business Environments: Many of these countries are making it easier to invest there. They’re changing rules to attract more venture capitalists.

This mix of factors means lots of chances for investing in new markets. Investors are starting to see the great possibilities in these areas. This is leading to more money and focus on exciting startups.

Venture capitalists are now looking far and wide for opportunities. Thanks to this, new markets are becoming key to the future of venture capital. They’re opening doors to new ideas and ways to make money.

Cultural Shift in Investment Strategies

There’s been a big change in how people invest lately. They now focus on inclusive venture capital and ethics in investment. This is because they want to mix up their investments and fund things in a good way. This creates benefits for society and the economy.

Diversity and Inclusion in Investment Portfolios

The Diversity VC movement has shown how key diversity and inclusion are. They say varied teams do better and come up with cooler ideas. By choosing to invest inclusively, you’re helping fairness and seeing better financial results too.

Startups led by a mix of people can adjust and solve problems well. This makes them appealing to those with venture capital to invest.

Rise of Ethical Investment

There’s also a big surge in ethical investing. According to the Harvard Business Review, this kind of investing helps fund big social projects. By looking at environmental, social, and governance (ESG) standards, investors back companies with big societal aims.

This focus on ethical investing shows we know the long-term perks of investing responsibly. It lets the venture capital world do well financially while making a positive impact on society.

Top Venture Capital Firms in the UK

In the UK, some venture capital firms stand out for making smart investments. They have a big impact on new companies, helping them grow and succeed. This plays a big part in boosting the UK’s startup scene.

Leading Players and Their Portfolios

Balderton Capital, Index Ventures, and Accel are among the UK’s top firms. Balderton focuses on early-stage companies and helped Revolut and The Hut Group grow. Index Ventures invested in companies like Deliveroo and Farfetch, showing its wide range. Accel supports startups such as Monzo and GoCardless, pushing innovative ideas forward.

Success Stories and Case Studies

Let’s look at some success stories. Balderton Capital helped Revolut grow into a big fintech player globally. Deliveroo changed the food delivery game with Index Ventures’ backing, leading to a successful IPO. Accel guided Monzo from its beginnings to become a top new bank in the UK.

These examples help us see how top UK venture capital firms boost the country’s startups. Their smart investments lead to big successes and change the business world.