Ever thought about what makes quality financial services stand out in the UK? In the complex banking world, we often ponder if we have the knowledge to choose the best. The choices that boost our financial health.

This guide goes deep into what makes UK banking advice top-notch. It covers everything from vital customer support to tech’s role. Our aim? To give you the knowledge for wise decisions, for a steady and bright financial future.

Understanding Banking Services

The banking sector has many services for different customer needs. These are split into basic and advanced. Knowing these options can help people and companies make smart choices.

Types of Banking Services

Banking services fall into two main groups: retail and commercial banking. Retail banking serves individual clients with key banking products. Commercial banking, however, is for businesses, giving them tools to aid their financial operations.

Basic Banking Services

For daily money management, basic banking services are essential. These include:

- Savings and Checking Accounts

- Personal Loans

- Credit Cards

- Bills Payment and Funds Transfer

These services are mainly offered by retail banks. They aim to provide convenience and safety for everyday financial tasks.

Advanced Banking Services

Advanced banking services offer more than just the basics. These include:

- Investment Banking

- Wealth Management

- Financial Advisory

- Corporate Credit Solutions

Businesses and wealthy individuals often use these services. Commercial banks provide these advanced solutions. They help with strategic financial planning and management for growth and stability.

Choosing the Right Bank in the UK

Choosing a bank in the UK requires careful thought. You should look into the bank’s reputation, its reliability over the years, and how much it focuses on its customers. This guide will help you understand key points for picking the best bank for you.

Factors to Consider

- Interest rates offered on savings accounts and loans

- Range of financial products and services available

- Accessibility of branches and ATMs

- Digital banking features and functionality

Bank Reputation and Reliability

The reputation of a bank is crucial. HSBC, Barclays, and Lloyds have earned trust over time. They are known for their solid foundation and dependability. Looking at reviews and ratings can tell you much about a bank’s service and how they solve problems. A good reputation is usually a sign of financial stability and reliable service.

Customer Service Quality

How a bank treats its customers is very important. Great customer service makes your banking experience better. The UK’s leading banks, like NatWest and Nationwide Building Society, are praised for their excellent customer service. This shows they are deeply committed to putting their customers first.

When you consider these important points and do your research, you can find a bank that fits your needs. Choosing from respected UK banks, making sure they focus on customers, will lead to a fulfilling banking experience.

How to Evaluate Good Banking Services

Checking out good banking services is key for your daily banking. When deciding, look at things like interest rates, fees, how easy it is to get to, and safety. We’ll cover these important points.

Interest Rates and Fees

Interest rates for savings and loans matter a lot when picking a bank. It’s smart to compare what different banks offer. Also, checking for extra costs can help avoid surprise fees. So, look for a bank with clear charges.

Accessibility and Convenience

It’s also vital to think about how easy a bank is to reach. Choose a bank with plenty of branches and ATMs near you. Banks with good online services make banking easier. They let you bank from home or on the go.

Security Measures

Keeping your money safe is a must. Go for banks that take security seriously. They should use things like encryption and have ways to spot fraud. Knowing a bank keeps your money and data safe is comforting.

Types of Accounts and Their Benefits

Choosing the right bank account is crucial for maximising your money’s value. There are accounts for everyday use, saving, or investment. Understanding these can boost your financial management skills.

Current Accounts

Current accounts support daily financial activities. They include current account perks like easy money access, cheque books, and online banking. You also get overdraft facilities and transaction rewards, making everyday finance handling a breeze.

Savings Accounts

For those aiming to save money, savings accounts are perfect. They offer savings incentives like higher interest rates. You can pick from instant or fixed-term accounts based on your saving needs and accessibility requirements.

Fixed Deposit Accounts

Fixed deposit accounts are for investing a lump sum over a set period. The benefit? Fixed deposit advantages are higher interest rates and guaranteed returns. They’re great for secure, growth-focused long-term investments.

Understanding current accounts perks, savings incentives, and fixed deposit advantages helps in making smart financial choices. It aligns with your financial goals and strategies.

Online vs Traditional Banking

Choosing between online and traditional banking is big for consumers. Each offers different benefits. Making a wise choice is key.

Advantages of Online Banking

Online banking brings easy access and speed. Users can handle their finances or check accounts anytime, from anywhere. It often means less fees, good interest, and fast service.

Drawbacks of Online Banking

But online banking has its downsides too. These include possible tech problems, security risks, and no personal chats. Also, not everyone can use online services well.

Benefits of Traditional Banking

Traditional banks offer a personal touch. Going to a branch means you can talk directly, get advice, and sort issues fast. Banks also offer unique services, like handling cash and keeping valuables safe.

Importance of Customer Support

In today’s competitive banking world, top-notch customer support is essential. It not only strengthens customer bonds but also helps keep them. With services available via phone, email, live chat, and social media, support should be easy to reach.

Quality service depends on the support team’s training and experience. Skilled personnel can quickly solve various problems. Banks investing in training often see better customer satisfaction.

The importance of prompt and helpful support cannot be overstated. For many, it’s a big reason they choose their bank. Having support available 24/7 greatly improves the customer experience.

Using technology like AI and chatbots can speed up responses to simple questions. But the human touch is crucial for more complex issues. It ensures personalised care that technology can’t match.

The success of bank customer service can greatly affect how clients view their bank. Banks focusing on outstanding support can improve their reputation and keep clients loyal.

Banking Services for Businesses

Efficient banking services are vital for any business to succeed. They help businesses of all sizes grow. This section explores the services banks offer and the challenges businesses might face.

Business Loans

Business loans are key for growth and maintaining working capital. They come in various forms like term loans and invoice financing. They help businesses at different stages, such as buying new equipment or managing cash flow.

Merchant Services

Merchant services are essential for businesses needing to process payments. They include credit card processing and e-commerce gateways. Companies like Worldpay and Barclaycard provide these services, helping businesses improve their sales.

Corporate Accounts

Corporate accounts are tailored to business needs. They offer features like high transaction limits and dedicated account managers. These accounts help manage large financial transactions and support global trade.

The Role of Technology in Modern Banking

Technology has transformed modern banking, making services more efficient and accessible. It allows customers and banks to interact easily. This piece looks at how technology changes banking.

Mobile Banking

Mobile banking apps let users manage their money with a tap on their smartphones. These apps offer conveniences like transferring funds and paying bills on the go. Big banks, such as HSBC and Barclays, keep adding new features to their apps.

Features like biometric checks and instant fraud alerts make banking safer and user-friendly.

AI and Chatbots

Now, AI helps with customer service and financial advice through chatbots. Banks like Lloyds and NatWest use AI to sort simple queries. This lets human staff tackle harder issues.

These chatbots are good at understanding what customers need. They make talking to banks easier and faster.

Blockchain and Cryptocurrencies

Blockchain is bringing in secure, clear transactions to banking. Banks are looking into blockchain for safer global payments. Cryptocurrencies are becoming part of bank services, too.

To wrap up, fintech is pushing banks forward. With mobile apps, AI, and blockchain, banking keeps getting better. These advances make banks more efficient and keep customers happy.

Tackling Banking Fraud

Fraud in banks is a big problem for customers and banks. It’s important to make banks safer and fight fraud. We’ll look at different kinds of bank fraud, how to stop it, and what to do if it happens to you.

Common Types of Bank Fraud

Bank fraud comes in many forms, each dangerous in its own way. Some common types are:

- Phishing: Scammers send fake emails or messages to steal personal info.

- Identity Theft: Someone illegally uses your personal information.

- Card Skimming: Thieves copy your card details during transactions.

- Cheque Fraud: Making or using fake cheques.

Preventive Measures

Banks and customers can do many things to prevent fraud:

- Regular Monitoring: Always check your bank statements for strange activities.

- Two-Factor Authentication (2FA): Use 2FA for better security when logging in.

- Security Awareness Training: Teach staff and customers how to spot and avoid fraud.

- Advanced Technologies: Use things like biometrics and AI to notice fishy stuff right away.

What to Do If You’re a Victim

If you think you’ve been hit by bank fraud, act fast to limit the harm:

- Report Immediately: Tell your bank right away if you suspect fraud.

- Freeze Accounts: Ask to stop all activities on your accounts to prevent more issues.

- File a Police Report: Let the police know so there’s an official record.

- Monitor Credit Reports: Keep an eye on your credit report for any dodgy dealings.

Making sure we have good security at banks and always being on the lookout are key. Both customers and banks need to work together to fight off financial crimes. Knowing the right steps to take if fraud happens is also vital in protecting our money.

Personalised Banking Services

Today’s financial world changes fast, and personalised banking services are key for meeting individuals’ unique needs. Banks now offer custom services to help clients reach their financial dreams. This section looks into these special offerings, like wealth management, personal banking advice, and custom financial products.

Wealth Management

Handling wealth wisely is at the heart of personalised banking. It lets clients plan their finances well with expert advice. They can face investment, retirement, and estate challenges more easily.

Personal Banking Advisors

Personal banking advisors are vital in providing custom banking help. They work closely with each client, giving personal advice for unique financial situations. These advisors guide clients through everyday banking and big financial decisions.

Tailored Financial Products

Banks create specific financial products to suit each client’s needs. These tailored options can include loans, investment products, and savings plans made just for you. Custom products make customers feel valued and satisfied.

In summary, personalised banking services like wealth management, advice from personal banking advisors, and custom products are crucial. They address the varied financial needs of clients perfectly. With these services, banks deliver thorough and effective financial management.

Banking Services for Students

Choosing the right student bank accounts is very important for young clients. These accounts offer benefits and features that meet students’ needs. They provide easy access to money, low fees, and good discounts.

Student bank accounts have services that help with money management. Banks offer budgeting apps, financial advice, and workshops. These help students learn to manage money well and build good banking habits.

These accounts also offer extra perks like travel discounts and deals on gadgets. There are also fee waivers for banking services. These benefits make banking beneficial and easy for students.

Getting the right bank and using educational financial services is great for students. Starting early with good finance management helps greatly in the future. So, it’s crucial for students to pick the best bank accounts for their goals.

The Future of Banking Services

The banking scene is set for big shifts. Thanks to tech advances and fresh thinking, it’s changing fast. Let’s explore new trends, fintech’s big role, and what’s next for banks.

Emerging Trends

A major trend is banks going digital. They’re using things like AI and blockchain to get better and serve customers well. There’s also a growing push for banks to be green and sustainable, as people want eco-friendly finance.

The Impact of Fintech

Fintech’s shaking things up in banking. With new ideas, like mobile payments and peer-to-peer lending, it’s making finance more accessible. It’s pushing banks to come up with new, customer-focused services to stay competitive.

Predictions and Outlook

In the future, banks will use more tech to change how they work. They’ll aim to serve you in a way that fits you perfectly, thanks to big data. Plus, with open banking on the rise, we’ll see even more innovation and competition, making finance better for everyone.

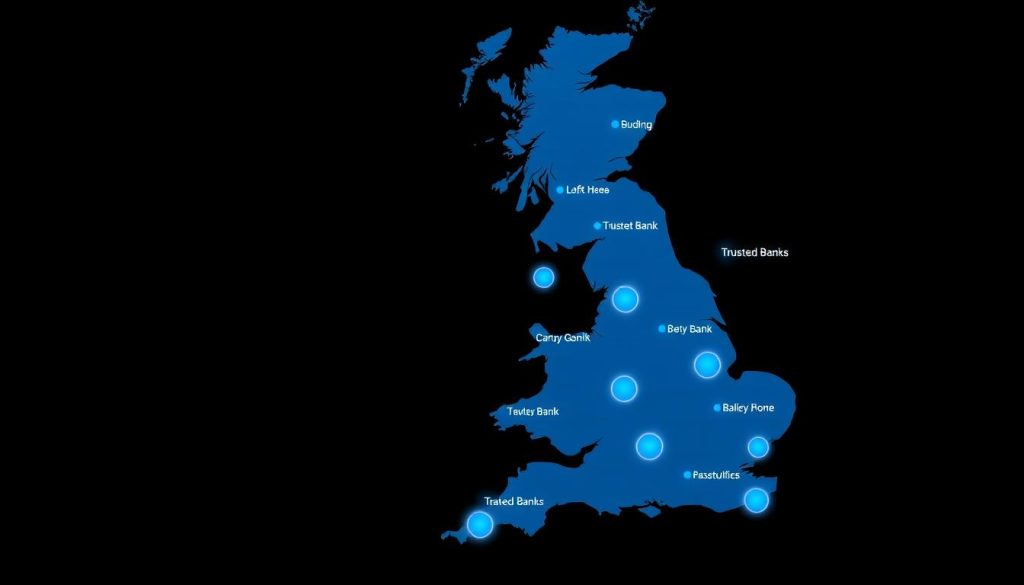

Top Banks in the UK Known for Good Banking Services

Looking for the best banks in the UK? Consider the top ones known for their excellent services. We’ve picked the banks that stand out for their high-quality services and trustworthiness.

- Lloyds Bank: Lloyds Bank is a leader in the UK. They provide many services, from personal to business. People love their digital tools and customer service.

- HSBC: HSBC is famous worldwide. They offer personal financial advice and wealth management. They’re secure and innovative, gaining a great reputation.

- Barclays: Barclays is well-respected for its wide service range and tailored products. They also have strong customer support and love tech advancements.

- NatWest: NatWest focuses on making customers happy and providing convenience. Their mobile app is easy and popular among users.

- Nationwide Building Society: Nationwide puts customers first. It’s known for good interest rates and clear information. They’re a top choice in the UK.

These banks are top-notch because of their customer service, tech, and security focus. If you need personal or business banking, these UK banks are reliable and offer full services.

Conclusion: Making the Most of Good Banking Services

In today’s world, using good banking services wisely is key. We’ve looked at what makes banking good, from basic services to tech use. Knowing these can help you or your business grow.

Picking the right bank means looking at their reputation and how they treat customers. You also need to decide if you want traditional or online banking. Each has its benefits. This helps in gaining financial security and supporting growth.

Banking’s future is all about new trends and fintech. This brings amazing new ways to manage money. Staying up-to-date with these can help keep your finances flexible. By using great banking services, your financial choices will support your success.