European investing opportunities offer a gateway to a diverse market, rich in technological advancements. It’s a place where a single market flourishes, making it a hotspot for investors. This makes Europe an ideal spot for Foreign Direct Investment (FDI).

With over 500 million consumers, the European Union (EU) holds a vast potential for businesses looking to expand. It provides a fertile ground for growth and profitability. Here, investors can tap into high levels of skills and innovative capabilities.

The market’s potential in the EU is huge because of its wide consumer base and sophisticated infrastructure. This setup is perfect for cross-border investments.

Key Takeaways

- The European Union encompasses a single market of over 500 million consumers.

- FDI in Europe enables access to advanced technological and innovative capabilities.

- Cross-border investments thrive due to the EU’s robust and diverse market landscape.

- Investing in Europe offers high potential for growth and profitability.

- The EU market potential leverages a comprehensive consumer base.

The Benefits of Investing in Europe

Investing in Europe offers many rewards, making it a great choice for long-term achievements. One key advantage is its large, well-connected market. This feature helps with easy access to one of the top economies globally. The chance for technological innovation further marks Europe as a prime location for investment.

Access to a Highly Integrated Market

Europe’s unified market offers a wide and cooperative space for companies. It makes trading across borders easy and helps businesses grow. With simplified operations, firms reach over 500 million customers. This supports Europe’s broader economic progress. Such a large and dynamic consumer market drives significant economic growth, creating excellent investment options.

Technological Development and Innovation

Europe’s commitment to technology is another reason to invest there. It leads in EU innovation, attracting investments that foster new industries and job opportunities. Europe’s progressive policies and clear investment conditions welcome investments from abroad. These efforts enhance infrastructure and ensure sustainable growth in Europe. They highlight the region’s appeal for business and individual investors.

To conclude, investment in Europe means entering a cohesive market and an innovation centre. Together, these elements promote Europe’s economic advancement. This makes Europe a top choice for smart investment decisions.

The Impact of Foreign Direct Investment (FDI) in Europe

Foreign direct investment (FDI) shapes Europe’s economic scene. It brings capital from outside the EU. This money is key for growth and progress in Europe. Each year, the continent pulls in €6.295 billion in FDI. This shows how attractive Europe is to global investors.

FDI has major benefits for Europe’s economy. It sparks technology progress and creates many jobs. By adding new money to various sectors, it encourages new ideas, more jobs, and better infrastructure all over the EU.

Europe is known for its welcoming FDI policy. This openness makes it a top pick for investors around the world. With such a positive setting, Europe becomes a dynamic place for economic development. This boosts its role in the world’s economy.

Key Sectors for Investment in the EU

The European Union is an attractive place for investors to look. It has key sectors like technology, infrastructure, and renewable energy. These areas are leading growth and modernisation in the EU.

Technology and Innovation

Technology and innovation are booming in the EU. This boom comes from continuous advancements and a strong research ecosystem. The EU’s focus on creating new technologies attracts investors. They come to be part of the digital change and invent new solutions. Fields like AI, blockchain, and biotechnology hold vast opportunities.

Infrastructure Development

Investments in infrastructure are vital for Europe’s growth. They help update transport, improve communication systems, and develop cities. The EU aims for sustainable growth. It offers chances for investing in long-term, socially beneficial infrastructure projects.

Renewable Energy

The EU’s renewable energy sector is quickly expanding. This growth is due to a focus on sustainability and the environment. Investing here means supporting cleaner energy like wind, solar, and hydro. The EU supports this sector with friendly policies, making it great for investment.

To sum up, Europe has several promising sectors for investment. Each sector helps build a sustainable, innovative future for the continent.

An Overview of the EU Single Market

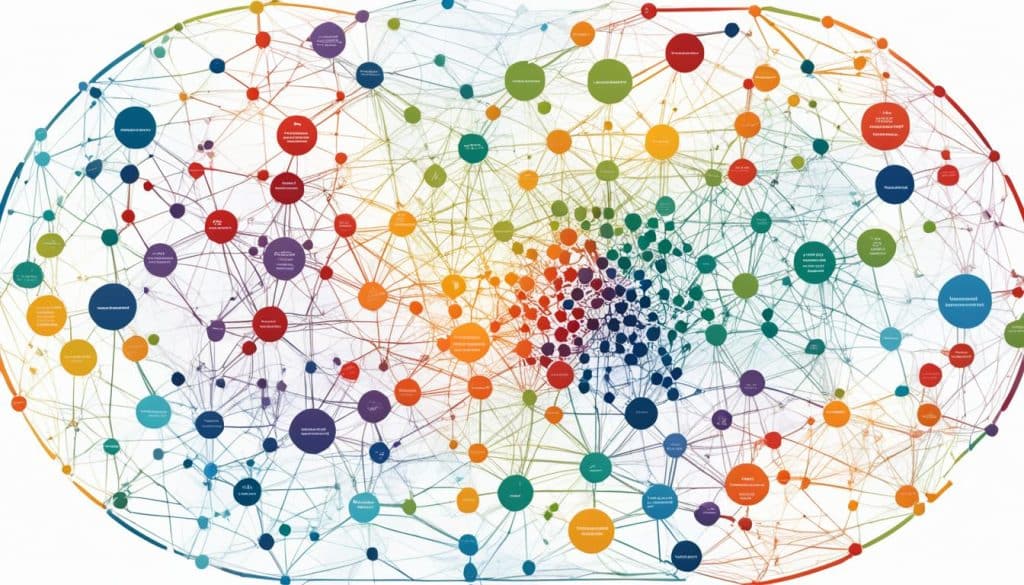

The EU Single Market is a key part of Europe’s economy. It allows goods, services, capital, and labour to move freely. This makes trading within the EU easy and links its economies closely.

This setup removes trade barriers and makes rules the same all over. It helps businesses work smoothly across different countries.

Thanks to the Single Market, companies can serve more customers and trade more easily inside the EU. They face fewer obstacles and can innovate more. This makes the EU’s economy strong and lively.

Overall, the Single Market helps businesses grow and compete better. It makes the EU a great place for trade and jobs. It’s essential for the EU’s wealth and future.

Investment Promotion Agencies in the EU

The European Union is home to many national trade and investment bodies. They support foreign investors with valuable guidance. These agencies help investors understand different markets, legal systems, and opportunities in specific sectors. Notable examples include ABA – Invest in Austria, GTAI – Germany Trade & Invest, and Business France.

Austria: ABA – Invest in Austria

ABA – Invest in Austria helps international investors enter Austria’s dynamic market. It offers detailed services like information sharing, networking, and fiscal incentives. ABA’s goal is to bring in sustainable investments and boost the economy.

Germany: GTAI – Germany Trade & Invest

Germany Trade & Invest (GTAI) is the go-to agency for foreign investors eyeing Germany. GTAI provides advice on the economic climate, industry insights, and investor incentives. This commitment ensures investors make well-informed decisions and smoothly navigate the investment scene.

France: Business France

Business France plays a crucial role in promoting international investment in France. This agency supports investors by finding investment opportunities, offering incentives, and giving market intelligence. Business France aims to make France a more attractive investment location, simplifying processes and fostering growth.

Private Equity Opportunities in Europe

The European private equity sector is full of chances for investors to make big profits. It’s varied, with opportunities from mid-market investments to venture capital. Each one offers unique benefits for different strategies to grow investments.

Mid-Market Private Equity

Mid-market private equity in Europe is strong and growing. It invests in medium-sized businesses with great growth potential. European firms use their deep market knowledge to pick and support these promising companies. This boosts both company growth and investor profits.

Venture Capital Investments

Venture capital supports new and innovative startups in the EU. These investments push forward technology and change industries. They’re essential for Europe’s entrepreneurial energy. By backing firms with big potential, venture capitalists boost the economy. They keep innovation and competition alive.

The European private equity scene is thriving with lots of investment chances. Those investing here, using their insights and understanding of the market, can see significant growth and returns.

How EU Legislation Supports Investments

The European Union makes it easier to invest with its laws. It helps people start and run businesses without unfair treatment. This makes the investment scene better for everyone.

Freedom to Establish a Business

In the EU, you’re free to start a business anywhere in its countries. This rule helps investors by making it easier to begin and manage businesses. It leads to more business activities and a better investment environment.

Non-Discriminatory Treatment of Investors

The EU protects investors with its fair treatment laws. It treats all investors the same, no matter where they come from. This fairness builds trust and creates a competitive, healthy business world.

Driving Growth and Employment in Europe

Investments are vital for Europe’s economy, lifting various sectors and the whole economy. By putting money into important areas and backing new business ideas, investors boost productivity in the European Union. This increases economic output and creates jobs in the EU.

Strategic investments make more jobs, keeping EU’s economy strong. By improving infrastructure, backing clean energy, and supporting new tech, big investments are made. This raises living standards and increases jobs in member countries.

Putting money into key areas modernises them and makes them more efficient, helping Europe’s economy grow. Funding start-ups and small businesses also helps create jobs in the EU. These businesses often lead in innovation, opening new chances and pushing the EU’s economy ahead.

The Role of Pension Funds in European Investment

Pension funds play a crucial role in the EU’s financial markets. They provide retirement security for many people. By investing, they also bring stability to Europe’s financial market.

Pension funds help generate investment returns in the EU. They invest in infrastructure, technology, and more. This boosts economic growth and stability.

By investing in infrastructure and real estate, pension funds promote financial stability. They generate significant returns too. The EU is updating its financial policies to encourage these investments.

Pension funds work alongside insurance companies and sovereign wealth funds. Together, they support the EU’s financial resilience. Their investments protect retirees’ futures and promote financial market growth.

Strategies for Success in European Markets

Success in European markets needs a careful plan. Investors can find success with the right market knowledge and strong partnerships. Here are important steps to thrive in these promising markets.

Understanding Market Trends

It’s crucial to study the market in Europe deeply. This helps find good opportunities and avoid risks. Investors must keep up with changing consumer habits, new rules, and tech growth.

By understanding the market well, companies can be ready for future changes. They’ll be set to take advantage of new chances that come up.

Building Local Partnerships

Creating strong local partnerships across the EU is key to success. Working with local companies brings lots of benefits. It gives you valuable insights, makes your business more trustworthy, and helps you start smoothly.

These partnerships help investors create a strong network. They get important knowledge and can grow in competitive places. Focusing on these alliances is essential for lasting success and growth in the EU.

Investing in Start-ups and SMEs in Europe

Putting money into start-ups and SMEs in Europe can lead to growth. It helps grow innovation and the economy. Europe’s strong focus on new ideas makes it great for investments.

Investing in EU SMEs and start-ups boosts entrepreneurship. It also helps the local economy and encourages innovation. These investments make it easier for businesses to get funding and grow.

Europe offers many resources and mentorship for SMEs and start-ups. Investors can get good returns while helping the economy. This makes Europe a top place for such investments.

Utilising EU Investment Platforms

The European Union has investment platforms to help investors in the EU Single Market. These platforms provide resources and guidance. They make investing simpler and help with making informed choices.

European Investment Advisory Hub

The European Investment Advisory Hub is crucial for investors. It offers advice and help, finding good projects and giving strategic insights. It’s great for understanding EU investments and finding what you need.

European Investment Project Portal

The European Investment Project Portal shows many investment chances in the EU. It connects project promoters with investors, making it easier to find each other. Investors find valuable info here to make smart investment decisions.

Using EU platforms like the European Investment Advisory Hub and the European Investment Project Portal helps investors. They get the support and info needed to do well. These platforms ensure investing in Europe is smoother and more successful.

The Future Outlook for European Investments

The future outlook for European investments looks very promising. This is because of evolving market opportunities and the development of new investment strategies. Europe’s stability and market dynamism play key roles. Technology advancements push innovation, creating new investment paths. Together, they make Europe attractive to smart investors.

European laws also support investor confidence. They provide stable and clear rules for investment. This creates a safe environment for placing money. Europe’s approach to global economic trends boosts this positive outlook. The EU’s focus on economic and tech growth makes it an enticing investment spot.

Looking ahead, the EU’s future market chances are tightly linked with global economic shifts. Areas like renewable energy and digital tech will draw major investments. Evolving investment strategies will help investors make the most of these chances. By keeping up with European trends, investors can thrive in its markets.