Want to seize the entrepreneurial opportunities in Norway and Sweden? Compare the procedures for forming businesses in these Scandinavian countries to find the right path to success.

Starting a business is an exciting endeavor, but one of the crucial decisions you’ll face is choosing the right location for your company. The location not only impacts your business’s legal and financial aspects but also plays a significant role in your overall success.

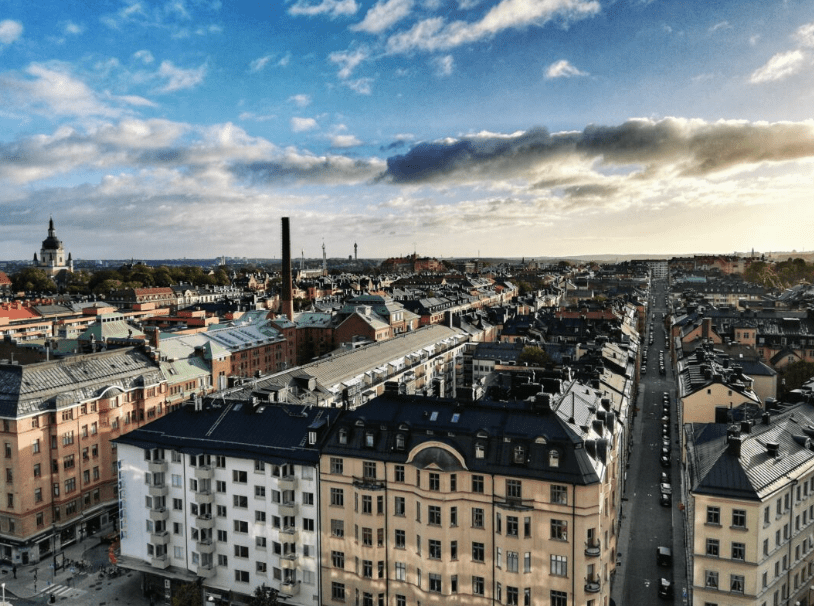

Norway and Sweden, both known for their economic stability and high living standards, offer promising opportunities for entrepreneurs. Norway, often praised for its natural beauty and oil-rich economy, boasts a robust business environment. With a stable political climate and a well-developed infrastructure, it has been consistently ranked as one of the easiest places to do business globally.

Sweden, on the other hand, is renowned for its creative spirit and has the largest economy in Scandinavia. It’s the birthplace of global brands like IKEA, Spotify, and Volvo, reflecting a culture of entrepreneurship and creativity. With a highly educated workforce and a tech-savvy population, Sweden offers a vibrant ecosystem for tech startups and research-driven businesses.

Both countries share a commitment to social welfare and a high standard of living, making them appealing destinations for business ventures. However, the devil is in the details when it comes to establishing a business. To make an informed decision, you must understand the legal requirements, tax implications, and the overall business environment in these countries.

Thus, we have written a comprehensive blog with all the details you might need to give a clearer picture of which country aligns better with your entrepreneurial dreams, making your journey into the business world a bit smoother.

Legal Framework in Norway

- Business Structures

In Norway, businesses can take various forms, each with its own advantages and considerations. The primary business structures include:

Aksjeselskap (AS):

Aksjeselskap (AS) is one of the most common business structures and is equivalent to a limited liability company. This structure offers safety in the case of financial troubles by clearly separating the company’s assets from those of its owners.

Norskregistrert utenlandsk foretak (NUF):

For smaller businesses or startups, the “Norskregistrert utenlandsk foretak” (NUF) is a popular choice, designed for foreign companies operating in Norway. They are relatively simple to establish and maintain, offering access to the Norwegian market without the complexities of a full AS structure.

- Registration Process

Registering a company in Norway involves a series of steps, which can be summarized as follows:

- Choose a Unique Company Name: Select a name that is not already in use and is compliant with Norwegian naming regulations.

- Prepare Necessary Documentation: Draft the company’s articles of association, specifying its purpose and operational guidelines.

- Register with the Brønnøysund Register Centre: Submit your registration application to the Brønnøysund Register Centre, Norway’s central authority for business registrations.

- Obtain an Organization Number: Following approval, your business will be given an organization number, which is necessary for a variety of administrative tasks.

- Tax ID and VAT Registration: Depending on your business activities, you may need to register for a tax identification number and a VAT number.

- Compliance with Capital Requirements: Ensure compliance with the minimum share capital requirements for your chosen business structure.

- Shareholding Structure: Determine the ownership structure of your company, which can be single-owner or involve multiple shareholders.

Legal Framework in Sweden

- Business Structures:

Sweden offers several business structure options, each catering to different needs and aspirations. Let’s take a look at the three most important business structures:

Aktiebolag (AB):

The most common corporate structure in Sweden is the Aktiebolag, or AB. It offers the advantage of limited liability, separating the company’s assets from the personal assets of its shareholders. The AB structure is versatile and can accommodate a single shareholder or multiple shareholders.

Handelsbolag (HB):

The Handelsbolag, or HB, is an appealing choice for people looking for a less complicated and more flexible business structure. Since there is no minimum share capital requirement, unlike the AB, it is open to startups and small firms. In an HB, each partner is fully liable for the debts and responsibilities of the business.

Enskild näringsverksamhet (Sole Proprietorship):

The Enskild näringsverksamhet, or sole proprietorship, is an excellent option for entrepreneurs looking to keep things simple. In this structure, the business is essentially an extension of the individual owner.

- Registration Process

Initiating a business venture in Sweden involves a systematic process including the following steps:

- Choose a Business Name: Start by selecting a distinct and available business name, adhering to Swedish naming regulations.

- Business Plan and Articles of Association: Draft a comprehensive business plan outlining your company’s objectives and operational strategies and prepare the Articles of Association.

- Register with the Companies Registration Office (Bolagsverket): The next imperative step is to submit your registration application to Bolagsverket, Sweden’s central authority for business registrations.

- Tax Registration: Register for taxes, obtain a corporate identity number (Organisationsnummer), and VAT number (Momsregistrering).

- Bank Account and Capital: Open a dedicated business bank account and deposit the requisite capital.

- Company Address: Provide a registered company address in Sweden, which can either be your business premises or a virtual office.

- Publication Requirement: Specific business structures may necessitate the publication of company details in a national newspaper.

- Business licenses and permits: Depending on your industry, different licenses and permits might be required from the relevant authorities.

- Insurances and Employee Considerations: If your business plan calls for hiring employees, secure the necessary insurance and abide by Swedish labor laws and regulations.

Tax Implications of Starting a Company in Norway

Starting a company in Norway comes with various tax considerations that can significantly impact your business’s financial health.

Corporate Income Tax (CIT):

Norway has a relatively high corporate income tax rate of 22%. However, it’s essential to note that CIT rates can vary based on factors such as the size and location of your business, and they are subject to change.

Value-Added Tax (VAT):

Norway imposes a value-added tax (VAT) on goods and services, with a standard rate of 25%. There are also reduced VAT rates for specific goods and services. Registering for VAT is mandatory if your business turnover exceeds a certain threshold.

Tax Incentives and Deductions:

Norway offers some tax incentives and deductions to encourage business development. These can include incentives for research and development (R&D) activities and deductions for interest on business loans.

Tax Implications of Starting a Company in Sweden

When considering launching a business in Sweden, it’s essential to grasp the tax implications that can have a major impact on your financial strategy.

Corporate Income Tax (CIT):

Sweden maintains a competitive corporate income tax rate of 20.60%. For Aktiebolag (AB), the most common business structure, the standard CIT rate remains the same. However, there are lower CIT rates for smaller companies, offering tax incentives for startups and small businesses.

Value-Added Tax (VAT):

In Sweden, all goods and services are subject to VAT. The standard VAT rate is 25%, but there are reduced rates for certain items like food, books, and public transportation. If your annual turnover is more than a specific threshold set by the government, you need to get registered for VAT.

Tax Credits and Deductions:

Sweden offers various tax credits and deductions, including research and development (R&D) tax credits and deductions for specific expenses, to promote innovation and growth.

Ease of Doing Business

Norway:

- Political Stability: Norway boasts a stable political landscape with a well-established rule of law. This stability contributes to a predictable business environment, attracting investors and entrepreneurs.

- Efficient Bureaucracy: Norway’s government agencies and institutions are known for their efficiency and transparency. Many administrative processes, including business registration, can be completed online, simplifying procedures for entrepreneurs.

- High Standard of Living: Norway offers a high standard of living, which is attractive for both skilled professionals and potential customers.

- Strong Infrastructure: The country maintains excellent infrastructure, encompassing modern transportation networks, reliable telecommunications, and high-speed internet access. These assets facilitate business operations and connectivity.

- Innovation and Research: Norway encourages innovation through investments in research and development (R&D). The country’s strong commitment to sustainability and technology creates opportunities for startups in green technology and renewable energy.

Sweden:

- Political Stability: Sweden enjoys a long-standing tradition of political stability and a strong commitment to the rule of law. This creates a predictable and secure business environment that appeals to both local and international investors.

- Innovation Hub: Sweden consistently ranks as one of the world’s innovation leaders. It invests significantly in research and development (R&D), creating an environment that encourages innovation and attracts tech startups and businesses focused on research.

- Global Connectivity: Sweden’s strategic location in Europe and well-developed transportation system make it a great hub for companies looking to connect to the world’s markets.

- Skilled Workforce: The country boasts a highly skilled and educated workforce. Swedish universities consistently rank among the world’s top institutions, ensuring a talent pool rich in expertise.

- Quality of Life: With first-rate medical, educational, and social services, Sweden provides an exceptional standard of living. This not only attracts skilled professionals but also contributes to a stable and content workforce.